One of the fundamental assessments we make at R&S Roofing is whether or not a homeowner ought to involve their homeowners insurance into their home repair solution. All cases are different and all carriers are different when it comes to the insurance claim process.

Upon arrival to an inspection our professional roofer does an initial overview of the exterior of the home, inspects the ground level for collateral storm damage, whether it might be window damage, gutter damage, or any other items typically assessed by a licensed adjuster. All items are documented and photographed for the homeowner to view upon completion of the initial overview.

After the ground level inspection our professional roofer heads up to the roof and conducts our multi-point inspection and determines whether the roof has actual storm related damages or is simply due for a replacement because of age.

Homeowners must keep in mind that Texas has extremely turbulent weather conditions, and drastic fluctuations in temperature. All these factors come into play when we are evaluating your roof's condition. Extreme heat causes brittleness to your shingles and can decrease its lifespan drastically.

Here are few steps from our multi-point inspection process:

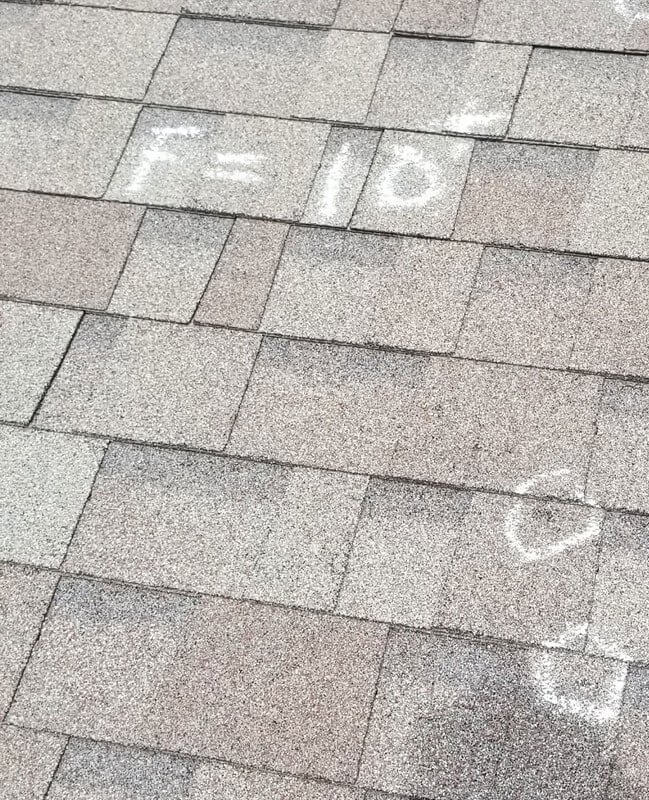

2. We photograph up close and aerial views for granular loss and determine age/ wear and tear of the roof.

3. We inspect shingle seals to determine longevity and structural compromise to homeowners roof, and inspect for possible wind damage.

4. Examine fastener placement and nailing patterns to determine proper installation. (Pulled fasteners, overdriven nails, nail pops, improper penetrations). Every insurance carrier has a different definition and policy when it comes to wind damage to your roof and property..

5. Depending on our standing with soft metal evidence we thoroughly inspect for possible evidence of hail damage to the shingle surface. We examine bruising, heat blisters, tree rub, possible wear and tear that could be used to work against homeowners in regards to an insurance adjuster inspection.

It is very important that R&S Staff be honest with homeowners about all aspects of their possible claim. All cases are different and one of the biggest downfalls of the industry are roofers over promising and under delivering when it comes to inspections. We want to stand out and give an honest opinion on each case depending on all the circumstances surrounding a homeowners roof.

At R&S Roofing we will handle the homeowners claim as if it were our own. WE ALWAYS arrive 30 minutes early to adjuster meetings and make the homeowners case for them. We share our documented findings with the insurance carrier and rarely have been turned down if we feel involving insurance is in the customers best interest.

Many roofers do not even inspect a roof before they prematurely involve insurance leaving homeowners angry and confused when their claim is quickly denied. Most roofers do not share with potential customers that having a denial on their record reflects poorly on them when they have a future claim that needs to be handled.

At R&S Roofing we follow the process all the way till completion and do not let the homeowner down when it matters most.

Call us today to let our Texas home owner insurance veterans walk you through a complimentary assessment of what roofing expenses your home insurance will cover.